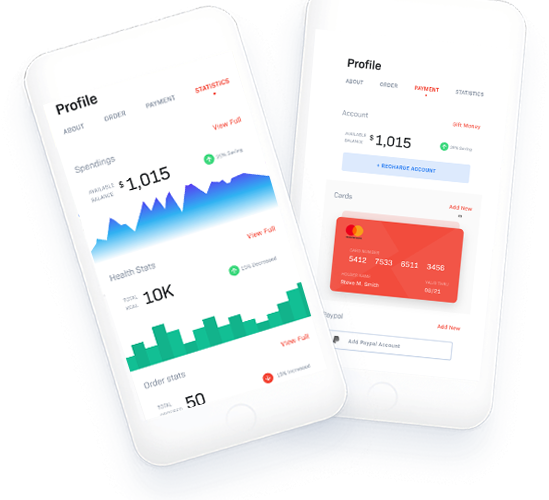

Mobile Banking Applications are essentially our mobile interface that allow your clients to interact with the accounts they hold at your financial institution, typically they can view details of their loan/savings accounts, transfer money between accounts, and transfer money to other users.

We’re a Banking-core & Payment Technology Provider,

providing technology for Microfinance, Sacco, Fintech, Mobile Payment & InsureTech.

Bills Payment & Money transfer made easy with our Module,

Digitize your revenue collection.

Resilient Payment Switch is Design with Banks, Money transfer in Mind.

with over 50 plus feature for your convenience.

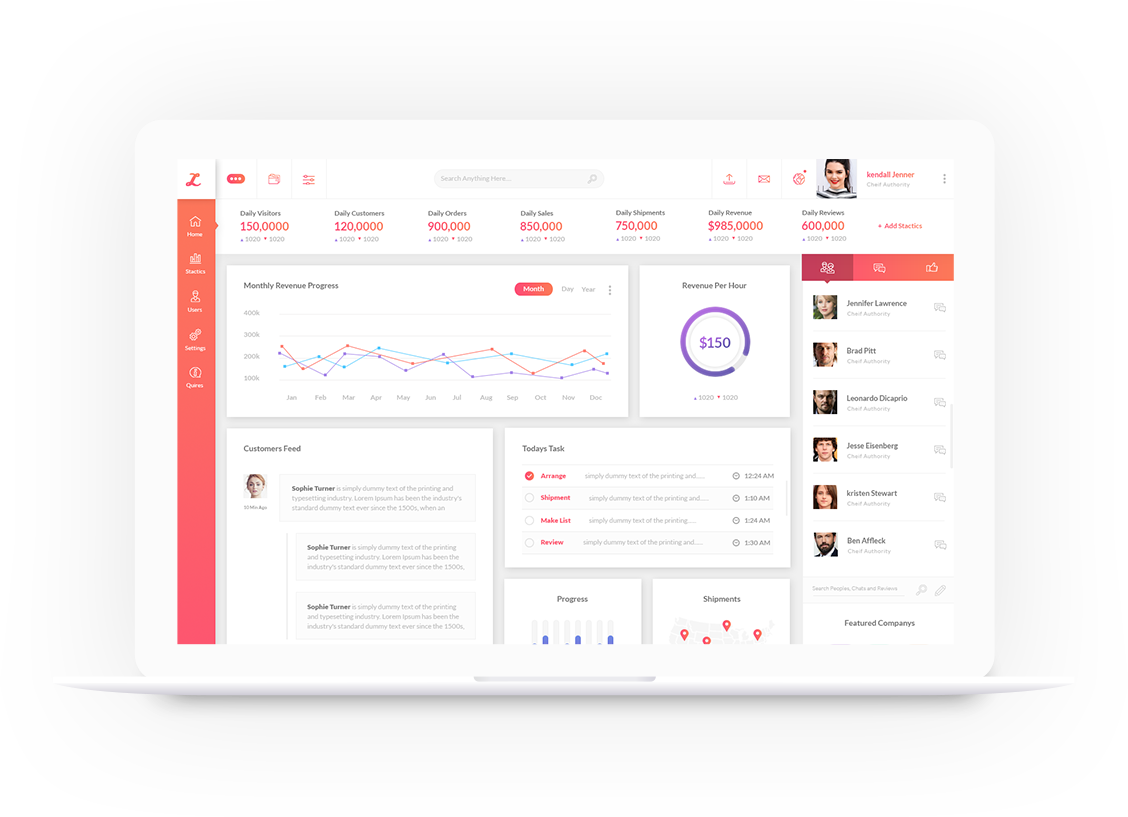

Our Digital core Bank has more features

that meets the current Fintech, Mobile Payment & InsureTech provider.

The system enables you to configure loan appraisal checks that are automatically applied prior to any loan approval or disbursement. These checks enable you to ensure that loans cannot be disbursed unless certain per-requisites are met.

Our core platform is readily integrate with Mobile Money service like M-PESA, Airtel Money and RePay to allow loans disbursal and loans repayment made easy. Our integration works in real-time thus the payment or disbursal reflects immediately.

Work processes can be broken down into required steps and all activities can be recorded and searched. Work roles can be defined with very specific permissions allowing you define and manage user access to information and decision-making and user passwords & log-in can be controlled.Eg, Configurable work flows, Role-based permission, Maker-checker work flows, Searchable audit trails.

We have various functionality with the robust accounting.

Cash or Accrual accounting, Custom chart of accounts

Automated portfolio posting, Advanced automated account posting

Full support for manual journal entries, Configurable accounting rules

Streamlined financial reporting.

Comprehensive client management functionality. Our core provides:

Client relationship management tracking, Client identity and document management so you can fully know your customer

Social performance measurement, Client credit scores provided by integration of partner solutions.